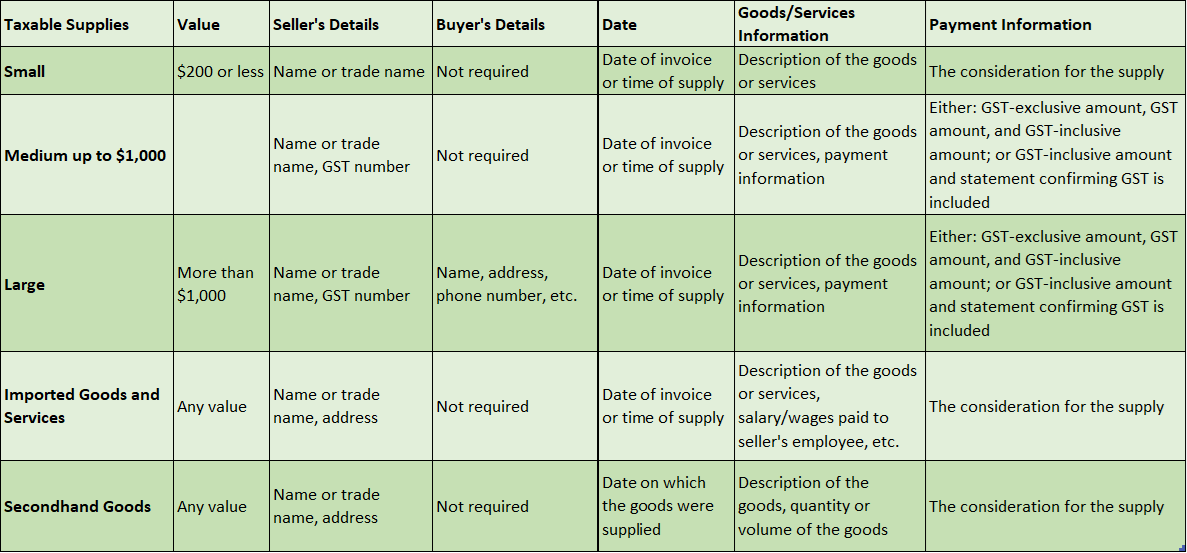

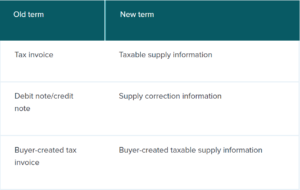

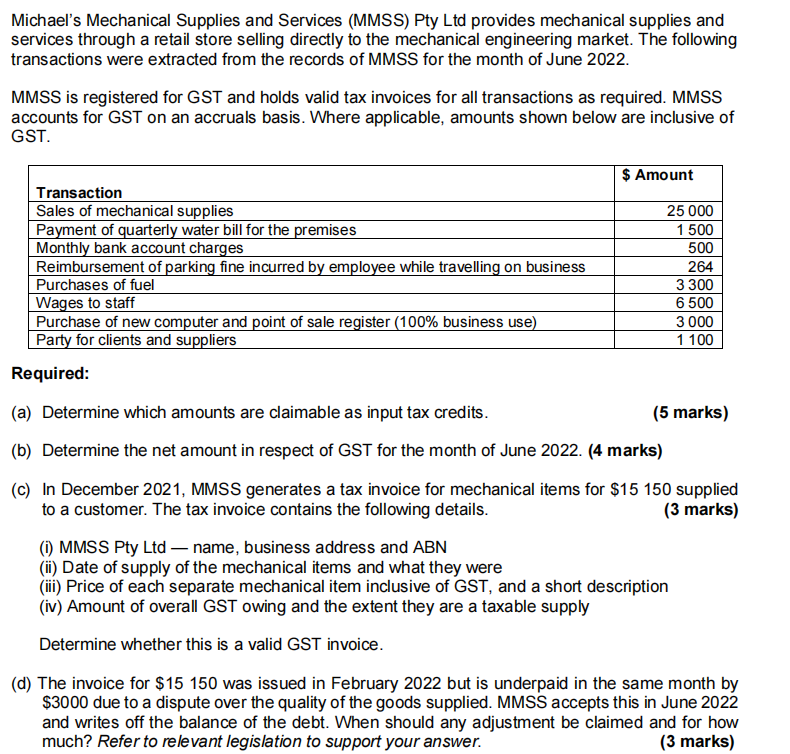

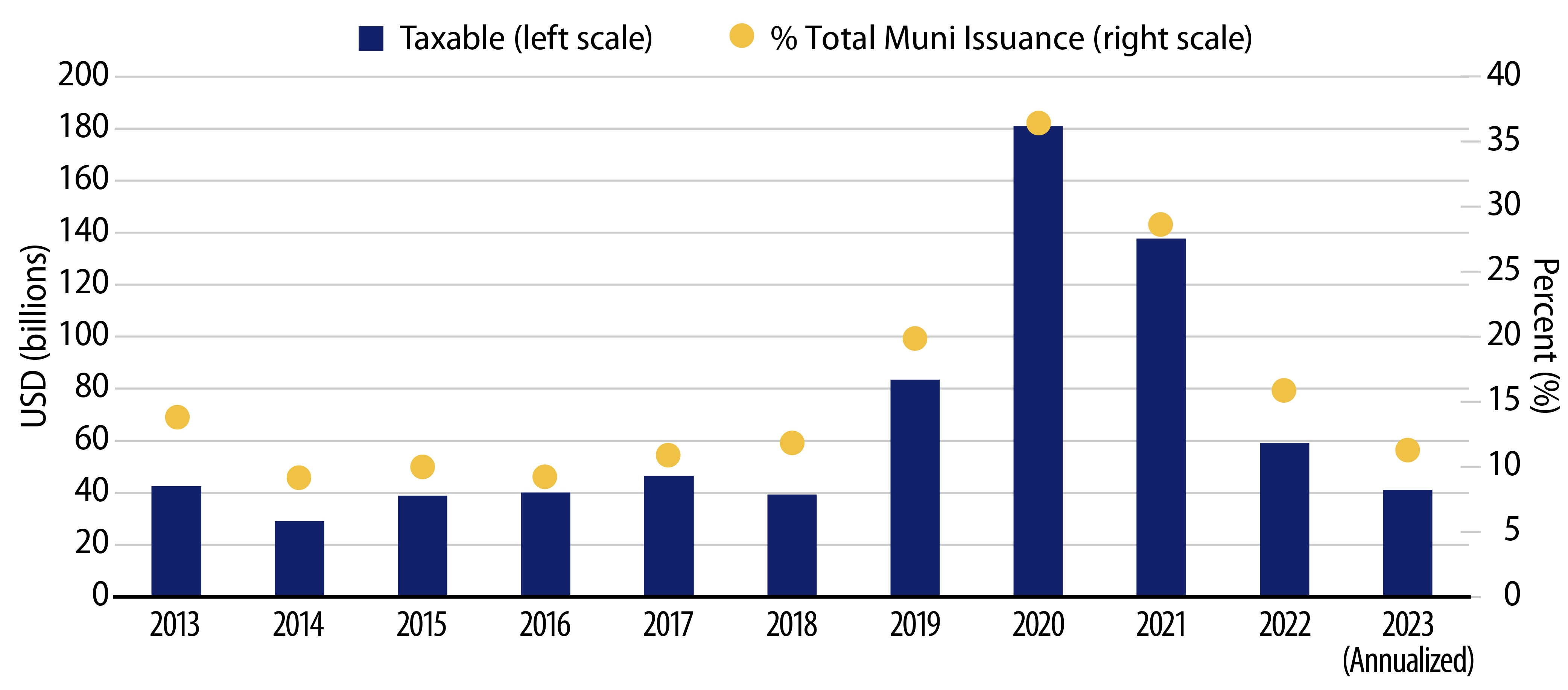

Leveraging the new taxable supply information requirements | Tax Alerts - April 2023 | Deloitte New Zealand

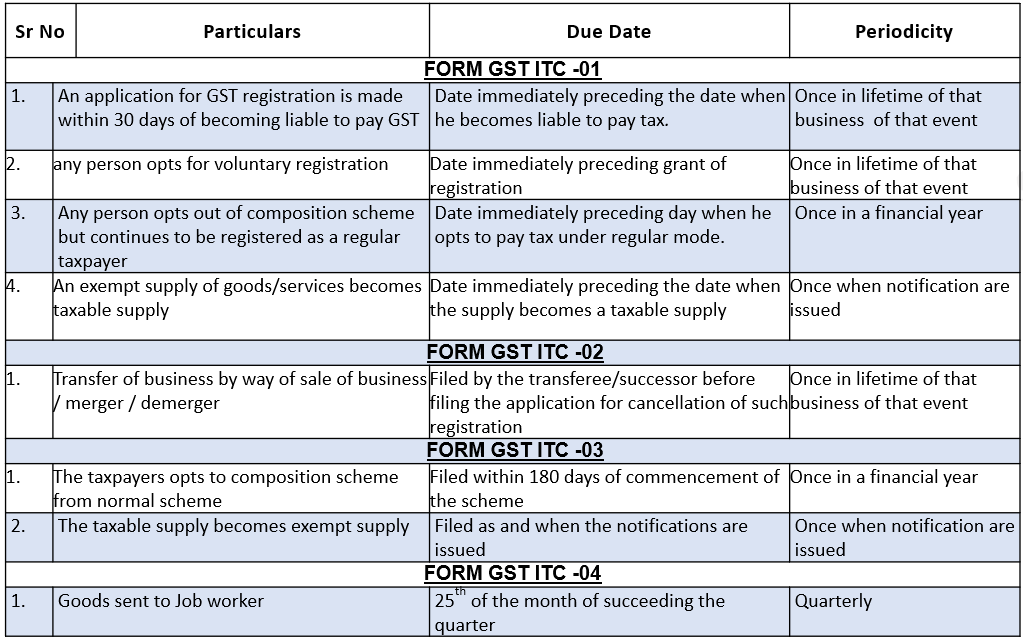

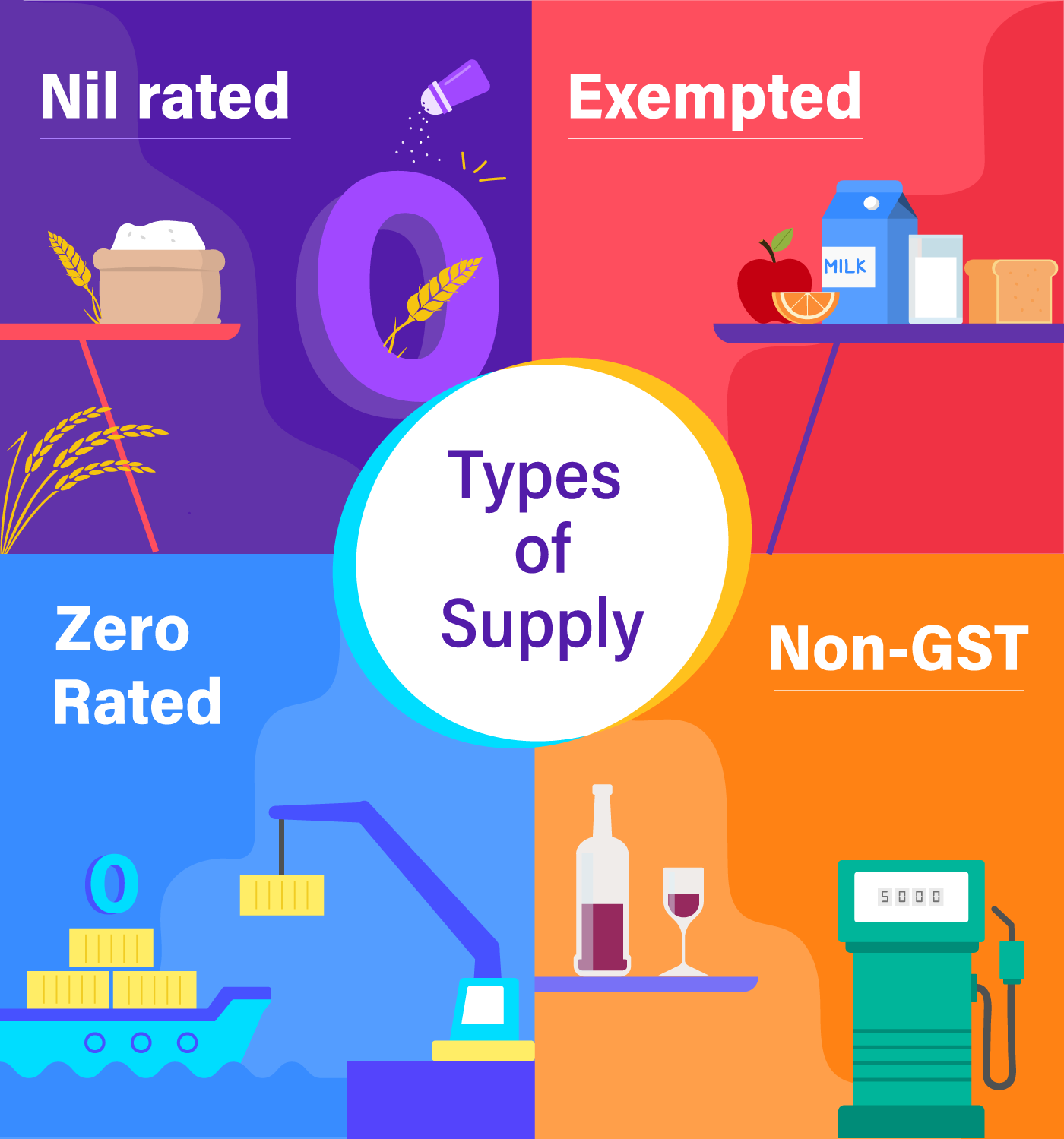

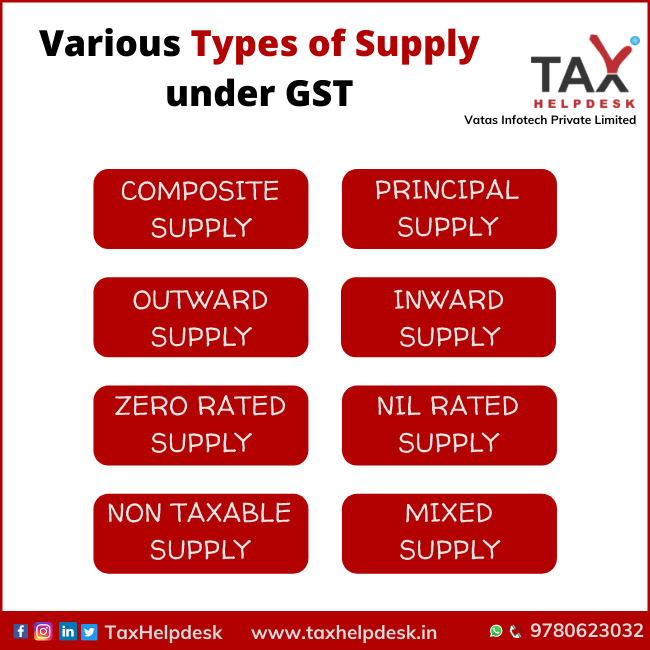

Tax Master - Have a more clear idea about GST and GST Act!😊 Know what you should & shouldn't pay under GST👍🏻 | Facebook

Leveraging the new taxable supply information requirements | Tax Alerts - April 2023 | Deloitte New Zealand